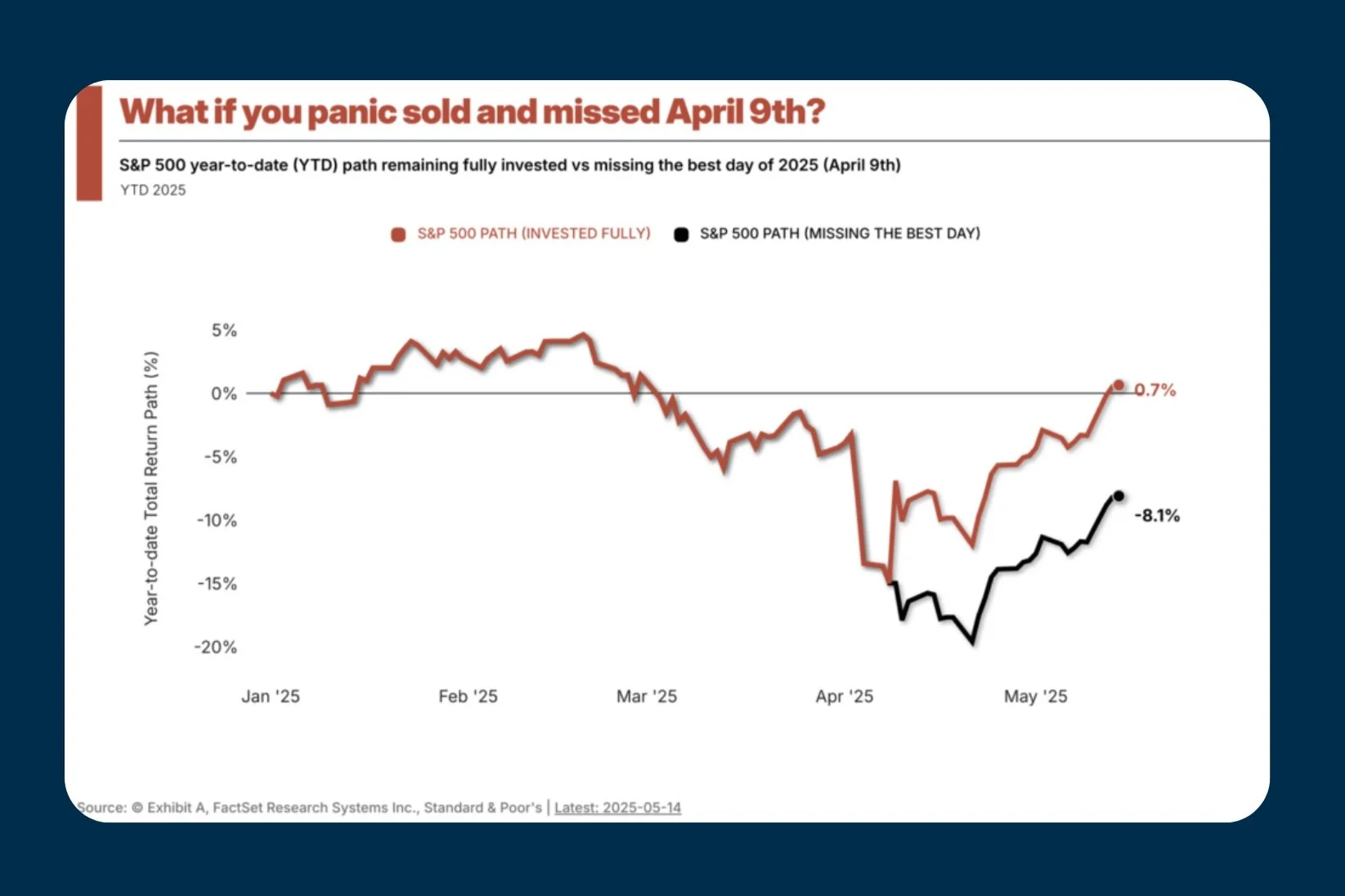

What if you Panic Sold?

The phrase “It’s not about timing the market, but time in the market” may sound cliché, but it continues to hold true. These past few months is yet another example. Investors who panicked and sold at the bottom into cash, would have locked in losses of around 15%. Even those who tried to time the market and missed just one key day (April 9th), would still be down nearly 9%. In contrast, if you simply held, it would have left you roughly flat. Market swings and sensational headlines can naturally trigger fear. However, the key is to be careful when acting on these emotions as it can be costly. Remain focused on your long-term objectives, and avoid letting short-term noise derail your long-term investment strategy.